1. Employee Support - FAQs and Knowledge Base - Paylocity

How do I access my W-2s and other tax forms? Desktop: Log in to Paylocity, select "Employee Self-Service" from the main menu. On the Welcome Card that says ...

Have a question? We are here to help. Access our Frequently Asked Questions for employee support. Contact your administrator for additional support.

2. Client Support - FAQs and Knowledge Base - Paylocity

Have a question? We are here to help. Access our Frequently Asked Questions for client support. Contact your administrator for additional support.

3. [PDF] Adjust Tax Withholdings in Paylocity Self-Service

Select the Taxes tab. Update the withholding information, then click on the Preview/Summary tab to preview how the changes will affect your net pay.

4. How do I update my tax forms on Paylocity? - Scribe

1. Go to [https://www.paylocity.com/](https://www.paylocity.com/) ; 2. Log in to your account using your username and password. ; 6. Select the tax form you need ...

If you are an employer who uses Paylocity to manage payroll and tax forms, it is important to keep your tax forms up to date. This is especially true if you have recently hired new employees or experienced changes in your business. Updating your tax forms on Paylocity ensures that your payroll and tax information is accurate and up to date, which can help you avoid any potential penalties or fines from the IRS.

5. Employee Onboarding Software for HR Teams - Paylocity

Collect Documents. A wizard-driven onboarding tool takes new hires step by step through handbook acknowledgment, collecting emergency contact details, setting ...

Employee onboarding tools to engage new hires from the start. Collect tax forms, I-9 verifications, and more to make processes more efficient.

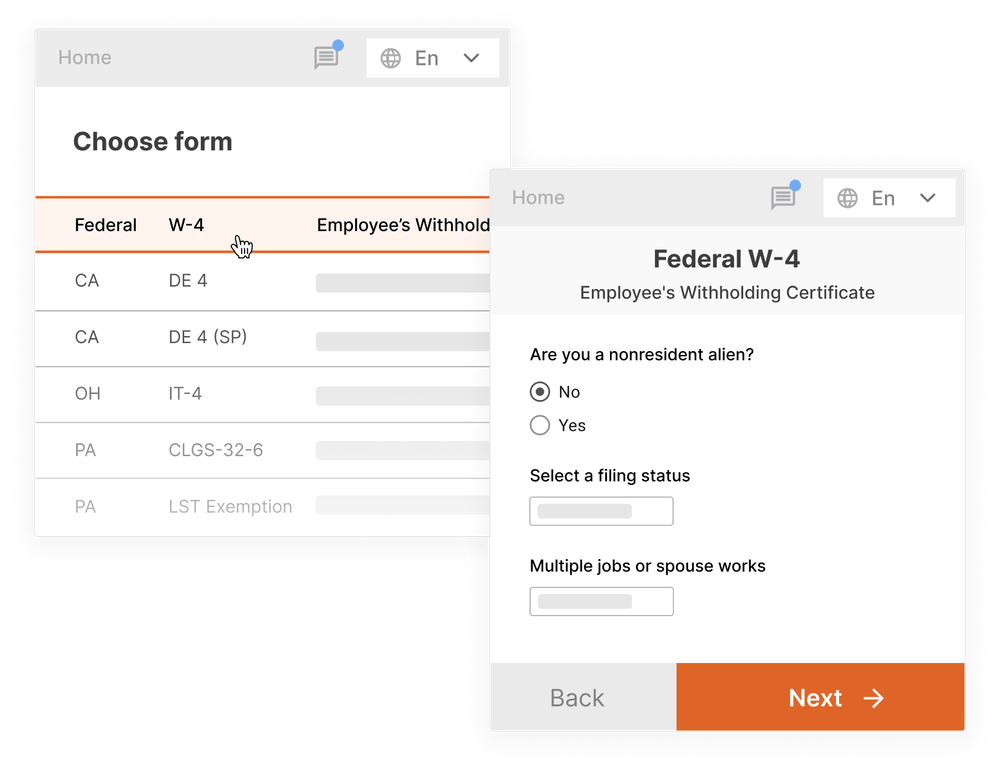

6. Online Withholding Forms | Local and State Tax Forms | Symmetry Payroll ...

Working on all browsers, devices, and platforms. Automatically applying nexus and reciprocity through Symmetry's multi-state wizard.

Automate the withholding forms process at the federal, state, and local level with over 125 compliant online withholding forms, including resident, nonresident, military spouse, and more.

7. Paylocity W2 - Fill and Sign Printable Template Online - US Legal Forms

Get Form. Keywords relevant to paylocity where is w2. paylocity withholding forms wizard not working; w 2 on paylocity; w2 form paylocity; w2 from paylocity; w ...

Complete Paylocity W2 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. Save or instantly send your ready documents.

8. W-4 Form Changes in 2020: What You Need to Know - Paylocity

Now that the form has been finalized, employers should use the new form for any income withholding election changes employees request starting January 1, ...

Employees hired in 2020 are required to complete the 2020 Form W-4. Form instructions and two worksheets are included with the form.

9. Calculate your paycheck with pay calculators and tax ... - PaycheckCity

Use our free paycheck calculators, net to gross and bonus calculators, Form W-4 and state withholding forms, 401k savings and retirement calculator, and other ...

Use PaycheckCity’s free paycheck calculators, withholding calculators, and tax calculators for all your paycheck and payroll needs.

10. Paylocity Releases New Onboarding and Web Benefits Software Solutions

14 aug 2014 · Ability to add announcements, documents, videos and other information the organization wishes a new hire to view; Withholding forms wizard, ...

ARLINGTON HEIGHTS, Ill., Aug. 14, 2014 (GLOBE NEWSWIRE) -- Paylocity Holding Corporation (Nasdaq:PCTY), a cloud-based provider of payroll and human capital...

11. 2024 Gross-Up Paycheck Calculator: Federal, State and Local taxes

Yes, the flat 37% rate applies even if an employee claims exemption in their federal Form W-4 from federal income tax withholding. Are bonuses taxed by states?

Use this gross up calculator to determine the take home or net amount based on gross pay. Perfect for any net to gross pay calculations.

12. IRS Provides Guidance on Form W-4 – Tax Alert - Paylocity

The 2018 Form W-4, Employee's Withholding Allowance Certificate, is not available yet. The IRS is working on revising Form W-4 to reflect new legislation made ...

In Notice 2018-14, the IRS publishes further guidance on the 2018 Form W-4, Employee’s Withholding Allowance Certificate and income tax withholding.

13. Payroll Tax & Compliance Resources - Paylocity

Record a simple how-to video with instructions to help your employees find their W-2s and other tax forms themselves. ... Get quick access to work ... If you do not ...

Stay up to date on current and evolving state or federal legislation affecting payroll compliance and taxes for your business.

14. What's a W-2? Wage and Tax Statement Explained | Paylocity

26 dec 2023 · Employers should also be ready to provide a Form W-2c to any employee who requests it, as incorrect forms can cause issues for the employee's ...

Form W-2 is one of the most important tax documents for U.S. workers. Learn employers' responsibilities for filling it out and filing.